Competition in the payment processor market is fierce due to the success of incumbent leaders, as the majority of retail small and medium-sized businesses (SMEs) are satisfied with their current processors. However, there are opportunities to stand out with lower transaction fees and differentiated services.

These are some of the findings from Main Street Health Q3 2023, a PYMNTS Intelligence and Enigma collaboration based on a survey of 509 SMBs with brick-and-mortar stores in commercial districts across the United States. It reveals the latest news on how business owners are reshaping their economic forecasts for the next 12 months.

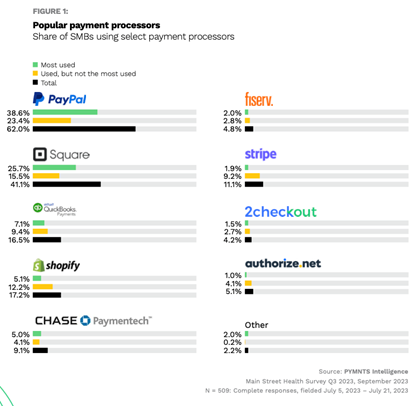

Main Street SMBs work with a range of payment processors, but it is a highly competitive and consolidated market dominated by two players: PayPal and Square, which together have 85% market share. Smaller, newer competitors share the remaining share of the pie, but these new entrants are the most vulnerable to change.

Customer loyalty to both leaders makes the sector a difficult battleground for acquiring new customers. Although it may appear at first glance that the payment processor market is consolidated and static, the competitive landscape could change in the coming years as 15% of leading SMEs express willingness to switch providers in the next three years .

Consider alternatives

When considering a change, the most relevant factor is transaction fees, which affect 59% of core SMEs. These results open the door for players to acquire new customers if they can offer more aggressive pricing policies and guarantee quality service.

Hospitality and consumer services companies are the most open to switching suppliers, making these sectors the next battleground for players looking to expand into new segments.

But price isn’t everything. Main Street SMB customers also value other features when choosing a payment processor. For example, 54% of respondents are interested in fraud detection and prevention, and construction stakeholders and retailers who have been in business for less than five years are most interested in these features.

On top of that, 53% look for processors that provide credit services. Meanwhile, more than 70% of consumer services SMBs are looking for processors that offer multiple payment options. Depending on these needs, offering improved services in these areas can be a differentiator in winning new customers, especially for SMEs with limited budgets that could benefit from complementary services, one of the most important characteristics for SMEs in the main Street.

Although the payment processor market is dominated by giants like PayPal and Square and most public sector SMEs express satisfaction with their current providers, lower transaction fees and specialized credit services present opportunities for newcomers. As the landscape evolves, focusing on these aspects can be a game changer for vendors looking to tap into new segments, especially for SMBs with limited budgets.

#SME #retailers #changing #payment #processors

Image Source : www.pymnts.com